World leaders from business and politics gathered this week at the World Economic Forum are charged with pondering how to strengthen ‘cooperation in a fragmented world’. Aspirations to tackle inequality, ensure climate justice and maintain financial stability may be peppering their inputs. But goodwill alone is not enough to resolve the mechanics of a system which has turbocharged global inequalities and eroded trust in global markets.

Indeed, sceptics will reasonably ask whether speeches from the attendees can ever offer the necessary solutions to prevent further fracturing of the world economy and the oncoming tidal wave of crises in developing countries. Especially so when many of the institutions the Davos elite represent—financial giants, technology companies and other multinational corporations—have been beneficiaries of that system.

Mostly invisible

Corporate power over markets, societies and the environment is a fact of everyday life around the world. It is visible in inflated prices for consumer goods, rent extraction from developing markets, ‘greenwashing’ and vaccine apartheid. But the structural underpinnings of that power—and, crucially, of corporate impunity—remain mostly invisible.

These lie in corporate arbitrage—strategic manoeuvring by corporations among different jurisdictional niches. This aims to avoid regulation which might otherwise come their way: ‘onerous’ taxation, accounting and reporting standards, social and environmental responsibility, labour standards and so on.

Such behaviour was reinforced by the World Bank’s now disgraced Doing Business Report. The assumption was that should a corporation establish a network of entities in different jurisdictions, this allocation of ownership stakes would be driven by ‘efficiency’ gains which need not affect the firm’s productive operations.

Macroeconomic consequences

A recent study by the United Nations Conference on Trade and Development (UNCTAD) finds however that corporate arbitrage generally—corporate equity chains in particular—does have macroeconomic consequences, especially for developing countries. Examining the equity chains of the top 100 non-financial multinational enterprises (MNEs), the research distinguishes patterns of corporate ownership in the global north and south. This allows a deeper insight into whether foreign direct investment (FDI), channelled through the corporate structure, creates new economic activity in the target country.

The study found that the most lucrative value-creation activities—legal infrastructure, financial, insurance, accounting, compliance services, research and development and so on—were typically placed in offshore financial centres and the ‘competition states’ of Europe. So even if hosted by a developing country, a global MNE would strategically locate the activities yielding most income elsewhere.

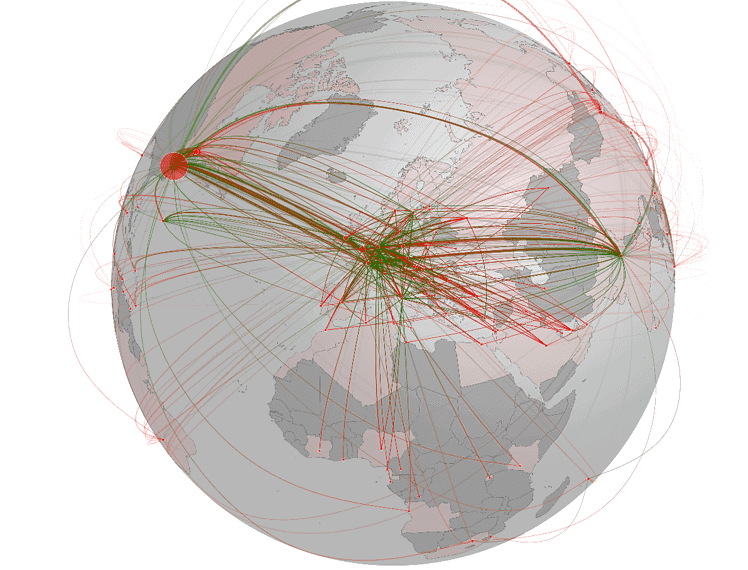

Figure 1 displays this network for a United States MNE. All interactions between the parent company and its subsidiaries in developing countries go through the United Kingdom. There is no direct relationship between the US and the developing country where the corporation invests. This pattern is typical of major corporations.

Figure 1: The global corporate structure of a (non-financial) US MNE

What is even more worrying for developing countries and advocates of global corporate accountability is that a quarter of the subsidiaries in the global south of the MNEs studied engaged in no apparent associated economic activity. They were dormant entities, phantom structures. In advanced countries, by contrast, the proportion of such entities in the overall corporate structure comprises less than 1 per cent.

Fragmented regulatory space

These findings throw up important lessons for the Davos set. First, success in attracting FDI is not, in and of itself, conducive to making incoming foreign capital work for the host economy and help it increase its productive capacity and associated employment and welfare.

Large corporate groups draw great benefits from the fragmented regulatory space. They are typically organised in such a way that subsidiaries exploit local economic advantages in the form of inexpensive labour, natural resources and so on, while other entities in the group located in other jurisdictions contribute to, and benefit from, value extraction via the localisation of profits, looser regulatory standards, low taxes and other arbitrage. Figures 2 and 3 show the equity structures of German and US MNEs respectively investing in the global south.

Figure 2: equity structure of German indirect investment in the global south

Figure 3: equity structure of US indirect investment in the global south

Secondly, the stripping out of earnings via corporate subsidiaries depletes the fiscal space of any host economy. Efforts to reform base erosion and profit shifting and introduce a global corporation-tax floor have begun to address part of this problem.

But taxation is only one aspect of the systemic regulatory framework needed to make corporate giants accountable. Without a more integrated approach to multilateral corporate and financial regulation, any increase in corporation-tax revenues is likely to accrue primarily to richer countries where these MNEs generate their revenues.

Thirdly, data transparency is crucial. Most data are owned by private corporations and public authorities at different levels may need to devise ways to get around this.

The European Union is the first regional body to seriously consider making it mandatory for large companies to spell out the details of their subsidiaries in corporate registers. Although it is being challenged by some member states’ concerns over potential revenue losses from data sharing, if implemented and integrated with similar efforts in financial regulation this could represent an important step towards systemic multilateral measures to render corporate behaviour accountable.

UNCTAD’s study also indicates that a developed regulatory framework at state level—allied to transparency, a networked civil society and independent media—can be effective in bringing corporations to account. Lower rates of phantom subsidiaries were found in regions with strong regulatory standards.

Distrust and fragmentation

Any serious discussion of the measures needed to bridge the world’s divides should start with recognition that ‘self-regulated’ global corporations and financial institutions have contributed to distrust in the global market and the fragmentation of national and regional political economies. Corporate power has expanded over the levers of democracy around the world, but it is in developing countries that the space for autonomous economic policy has diminished most sharply.

If Davos 2023 fails to bring to light the role of corporate power in driving the rifts in the world economy, the crisis will continue unabated.

Anastasia Nesvetailova is head of the macroeconomic and development policies branch of the Globalisation and Development Strategies division of the United Nations Conference on Trade and Development (UNCTAD).