In April, Prime Minister Petteri Orpo’s centre-right National Coalition Party, leading Finland’s government, convened for critical mid-term economic policy negotiations. Since assuming power in the spring of 2023, the coalition has pursued stringent fiscal consolidation measures, ostensibly to achieve fiscal sustainability. However, the outcomes of the April talks, which included significant tax cuts for high-income individuals and corporations, have raised questions about the government’s true objectives, with critics arguing that fiscal sustainability is merely a pretext for weakening organised labour and dismantling the welfare state.

The government’s austerity measures have manifested in severe spending cuts across critical sectors, including healthcare, social benefits, government agencies, and civil society. Additionally, regressive tax increases, notably a 1.5 percentage point rise in the basic VAT rate to 25.5 percent, have further burdened the population.

Despite the government’s claims that these policies would stimulate economic growth, the anticipated recovery has yet to materialise. The economic downturn, which began in 2023, persists. The government’s employment strategies, primarily focusing on social security benefit reductions, aimed to boost work incentives and create 100,000 new jobs. However, this strategy has proven ineffective, as the lack of available vacancies has resulted in an over 50,000-person increase in unemployment during the government’s first two years. The current unemployment rate stands at 9.2 percent.

While the government attributes its failure to restore growth and employment to adverse economic conditions, critics argue that the austerity measures have exacerbated the situation by suppressing domestic demand. A Keynesian think tank, the Finnish Centre for New Economic Analysis, has posited that these policies may have been counterproductive in stabilising the debt-to-GDP ratio, due to their detrimental effects on demand.

Beyond the questionable economic outcomes, the social costs are becoming increasingly apparent. Projections indicate a 9.2 percent increase in poverty and a 13.6 percent rise in child poverty. After a period of decline, homelessness is once again on the rise, driven by cuts to social benefits and housing services. The government’s dismantling of social housing is also expected to escalate housing costs.

This spring, the government executed a notable fiscal policy shift. Following two years of austerity, it opted to loosen fiscal constraints to provide tax relief for affluent individuals and corporations. While further spending cuts were implemented, they only offset approximately half of the lost tax revenue.

The government’s actions align with the demands of business lobby groups, which have recently advocated for substantial tax cuts, despite previously citing fiscal sustainability as justification for welfare state reductions. The most significant tax cuts include a two-percentage point reduction in the corporate income tax rate from 20 percent to 18 percent, and a six-percentage point decrease in the highest marginal tax rate from 58 percent to 52 percent, primarily benefiting those earning over €9,000 per month.

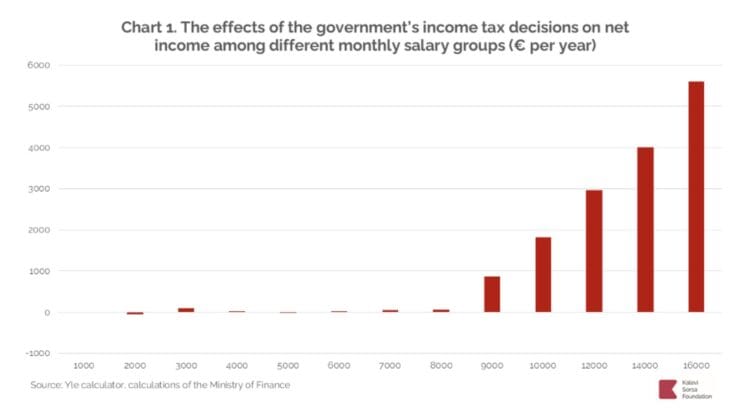

These tax cuts are projected to increase annual deficits by nearly one percent of GDP. While income tax cuts have been implemented across all income brackets, the removal of certain tax deductions, such as union membership fees, has resulted in minimal tax changes for those earning less than €9,000.

The chart takes into account income tax cuts which take effect in 2026 as well as the removal of the tax-deductible status of union membership fees and the home office deduction. The increase in unemployment insurance fees is not taken into account in the chart. Union membership fee is assumed to be 300 € per year. The actual fees vary between unions and salary sizes.

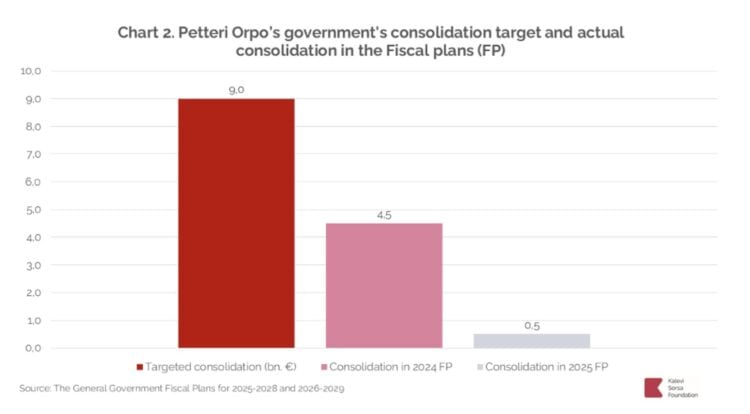

The government’s shift towards tax cuts indicates a departure from its previously stated fiscal policy targets. Prior to this spring, the government aimed to consolidate public finances by nine billion euros annually. However, the actual consolidation amounted to approximately half of that figure. The new policy decisions have further reduced the consolidation to a mere half billion euros (chart 2).

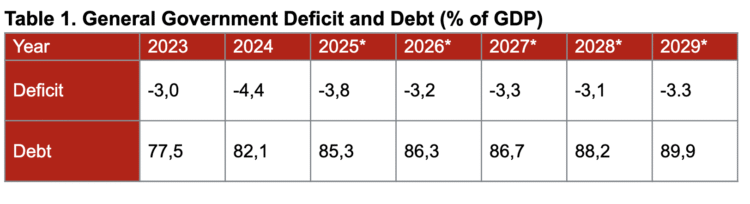

Furthermore, the government is failing to meet its target of stabilising the debt-to-GDP ratio. Projections suggest that the ratio will continue to rise, approaching 90 percent of GDP by 2029. General government deficits are also expected to exceed the EU fiscal policy rule threshold of three percent of GDP annually until 2029.

Source: Economic Survey, Ministry of Finance, Spring 2025, p. 78. *Forecast

As Clara Mattei has argued, right-wing austerity policies are not primarily aimed at fiscal sustainability, but rather at increasing profit margins and compelling workers to accept the economic imperatives of capitalism. Similarly, Orpo’s government is enhancing corporate profit margins and shifting the balance of power from labour to capital.

These policies have significantly eroded the government’s popularity, particularly that of the right-wing populist Finns Party, the second-largest party in the coalition. The party suffered substantial losses in the recent regional and municipal elections and is currently polling at 10.5 percent, a significant drop from the 20.1 percent it garnered in the parliamentary elections two years ago.

This decline may be attributed to the stark contradictions between the government’s policies and the Finns Party’s pre-election promises. For instance, party leader and current Minister of Finance Riikka Purra pledged that the party would not accept benefit cuts for low-income groups, a promise that has been directly contradicted by the government’s actions. The Finnish context suggests that combining a populist agenda with austerity policies is proving to be a difficult undertaking.