The era of unbridled hyperglobalisation, characterised by a relaxed attitude towards dependencies on other countries’ resources, productive capacities, and technological competencies, has ended. Recent global disruptions – from critical product shortages during the COVID-19 pandemic to energy price surges following Russia’s invasion of Ukraine, and the intensifying geopolitical and geoeconomic rivalry between China and the United States – have forced the European Union to reassess its traditionally liberal approach to trade, investment, and technology. A surge in protectionist policies, coupled with the pervasive influence of Silicon Valley’s “surveillance capitalism” and the increasing willingness to weaponise economic dependencies, now threatens the EU’s autonomy and sovereignty. This is particularly critical in areas vital for its future prosperity and stability, such as the green and digital transitions, and healthcare. The erosion of domestic productive and technological competencies due to outsourcing and offshoring, leading to the expansion of efficient but fragile, highly concentrated, and often China-centric global value chains, is now recognised as a primary concern demanding industrial policies previously considered undesirable.

Consequently, economic and, specifically, technological dependencies have become a significant threat to both the EU’s economy and its autonomous policymaking. As the Draghi-Report aptly acknowledges, “If the EU does not act, we risk being vulnerable to coercion.” Countries with strong technological foundations benefit from path dependencies, positive dynamic scale effects arising from accumulated knowledge, and crucial network effects, particularly in digital technologies. Thus, technology-gap models of economic development suggest that a lack of competencies in key technologies can precipitate a vicious circle of relative decline and divergence.

From Technological Dependence to Technological Sovereignty?

Given that mastery and availability of technologies are essential for a successful twin transition and sustained productivity growth, technological dependencies are viewed as a significant source of structural vulnerability for the EU’s socioeconomic development. In 2019, former Internal Market Commissioner Thierry Breton cautioned against an “over-reliance on foreign technology in strategic sectors of the economy”. He advocated for the EU to strive for “technological sovereignty”, a concept initially applied to digital technologies, such as 5G, but since extended to other critical technologies.

A widely accepted definition proposes that technological sovereignty is a jurisdiction’s ability “to provide the technologies it deems critical for its welfare, competitiveness and ability to act, and to be able to develop these or source them from other economic areas without one-sided structural dependency.” This does not equate to national autarky, as sourcing technology from abroad remains a viable option. In the case of imports, technological autonomy is achieved when there are no non-competing imports of goods and services related to key technologies. This implies that domestic firms should be capable of providing substitutes and surge capacity for key technologies in the event of supply chain disruptions or geopolitical tensions. While this may incur short-term static inefficiencies and costs, it is essential to retain the “ability to act” in accordance with European values in a world marked by geopolitical conflict and assertive national self-interest. More broadly, technological sovereignty can be considered a prerequisite for the wider concept of economic sovereignty, which in turn underpins the EU’s objective of strategic autonomy.

Technological dependence is likely to be high when technology serves as a critical input and domestic capacities, mastery, or availability are lacking. Standard indicators used to analyse technological capabilities include research and development (R&D) activities, patents, scientific publications, and trade and production of technology-intensive products. This analysis begins with a general overview of the EU’s technological dependencies by examining international flows of R&D resources and the position of EU firms among the top 1,000 global innovators, before focusing on a portfolio of key technologies, with an emphasis on digital technologies.

The EU is Falling Behind in R&D Investments

Technological capabilities and absorptive capacity are determined by available resources and their efficiency. In 2023, measured in constant US dollars at purchasing power parity, the US and China spent 63 percent and 55 percent more on R&D than the EU, respectively. Furthermore, R&D investments in the EU are growing more slowly than in China and the US, resulting in China outspending the EU on R&D since 2015. Regarding financial flows, China and Japan receive only approximately one to two percent of their R&D financing from foreign countries, whereas for the EU and the US, this figure stands between 20 percent and 24 percent.

That said, developments are more intricate in the age of global value chains, as R&D inputs are also embedded in intermediate goods that may be shipped multiple times between countries before reaching their final use. Following this reasoning, a recent study commissioned by the European Commission uses the share of imported R&D to total R&D as a technology dependency indicator, which accounts for trade in intermediate goods within global value chains. The results indicate that in 2020, only about two percent of the total R&D used in the US was imported, making the US the least dependent country. The respective figures for Japan (five percent), the EU (11 percent), and China (22 percent) are higher. Of the 11 percent of imported R&D for the EU, less than 10 percent originates from China. While China relies more on imported R&D than the EU or the US, it has reduced this dependence by approximately 30 percent since 2010 due to high growth rates in domestic R&D investments. Concurrently, a significant increase in imported R&D from China in total final goods production for almost all countries, including the EU, has been observed.

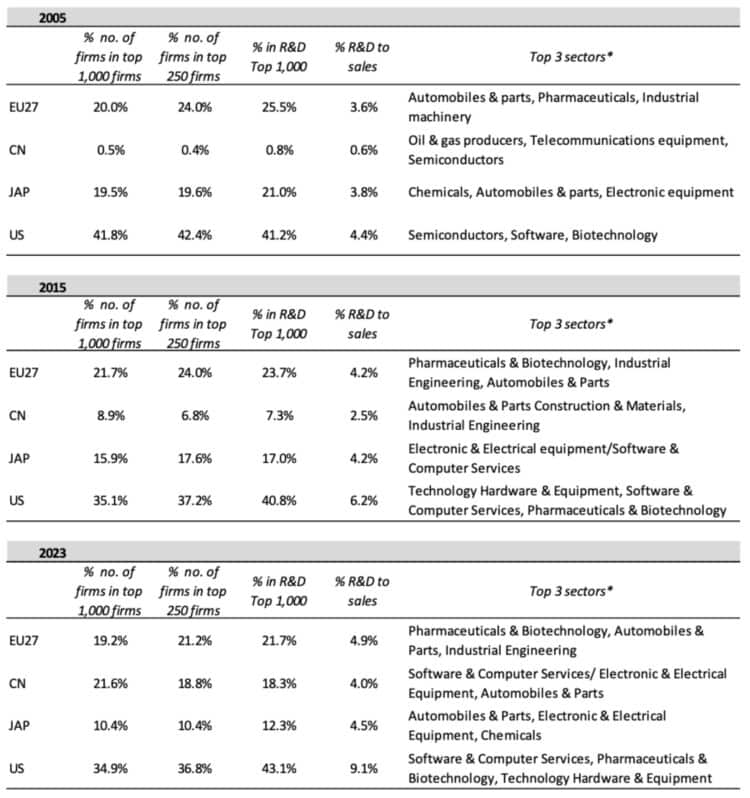

As firms are central to innovation systems and global value chains, focusing on the role of EU companies is particularly important. Notably, the EU’s R&D shortfall compared to China and the US primarily stems from inferior R&D performance by the EU’s business sector. The R&D intensity (defined as R&D as a percentage of GDP) of EU firms is only half that of their US counterparts and 75 percent of that of Chinese firms. The share of EU firms among the top 1,000 global firms in terms of R&D investment declined from 20 percent to 19.2 percent, and from 24 percent to 21.7 percent for the group of top 250 firms (see Table 1). An even faster decline can be observed for the US and Japan, but the US still holds a much higher share of leading R&D firms than the EU. In contrast, China has increased its proportion among globally leading firms from almost zero to approximately 20 percent, nearly on par with Europe. Even more telling is the percentage of R&D investment: in 2005, about 26 percent came from EU companies, which declined to 22 percent in 2023. Conversely, US firms managed to maintain their share of approximately 42 percent. This was possible because US firms more than doubled their R&D intensity (measured as R&D over sales) from 4.4 percent to over nine percent. Meanwhile, EU firms increased their R&D intensity by merely 34 percent, significantly less than Chinese firms, which boosted their R&D intensity by 60 percent between 2015 and 2023. This divergence between EU companies on one side, and US and Chinese companies on the other, can largely be explained by structural change: while dominant R&D-intensive EU firms continue to operate in broadly the same economic sectors, Chinese firms rapidly shifted from more traditional sectors in 2005 to ICT-related activities in 2023, which exhibit much higher R&D intensities than more traditional, medium-tech sectors like automotive or industrials.

Table 1: Performance of top 1000 world leading firms in R&D, 2005-2023

*Defined as the three sectors with the largest numbers of companies. Sectors are ordered in descending order of importance.

Source: Authors’ own calculations based on EU Industrial R&D Investment Scoreboard data.

Dependencies on Foreign Digital Technologies Abound

A more nuanced picture emerges when shifting from the country level to the technology level. Following the German Commission of Experts for Research and Innovations, 12 key enabling technologies can be distinguished across production, materials, digital, and bio- and life sciences. A country’s relative strength in a technology can be measured by its revealed comparative advantage in the trade of that technology. Empirical analysis reveals that the EU has a comparative advantage in only two of 13 key technologies: advanced manufacturing and life sciences. Notably, the EU lacks a comparative advantage in any of the six key digital technologies. China, conversely, commands a comparative advantage in all six key digital technologies and only lacks one in life sciences.

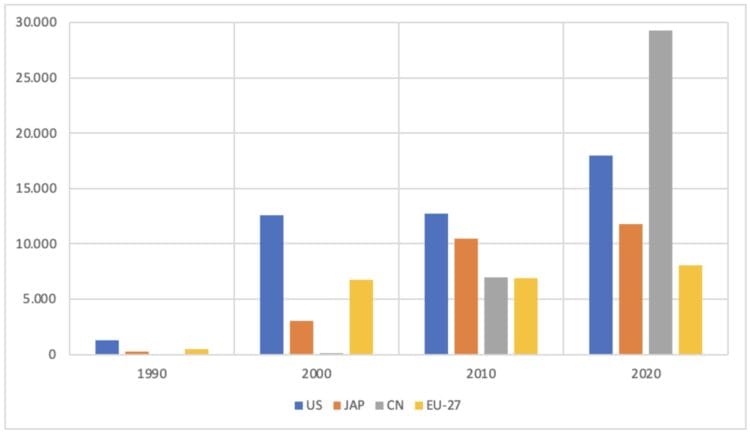

Focusing on patents as another key indicator for technological prowess, divergent dynamics appear. In 1990, the EU possessed approximately half as many ICT patents as the US and has been unable to close this gap since (see Figure 1). Despite a rise in annual patent applications from about 500 in 1990 to 8,000 in 2020, the EU was overtaken by Japan and China in ICT patents in the 2000s and 2010s, respectively. The most striking development, however, is China’s catching-up and leapfrogging: it outperformed the US and, with almost 30,000 patent applications in 2020, advanced to become the most productive country in ICT patenting.

Figure 1: Number of ICT-related patent applications

Source: OECD MSTI Database

That said, it would be inaccurate to portray the EU as entirely lacking strengths in digital technologies. Firstly, the EU possesses a relatively strong scientific base, including in digital technologies. For instance, the EU’s 15 percent share in global AI-related publications in scientific journals outweighs the respective share for the US (10 percent), even though it falls short of China’s output (34 percent). Yet, for AI-related patents, the US outperforms the EU (22 percent versus five percent), with China once again demonstrating superiority (48 percent). This weakness in translating scientific excellence into commercial applications has been termed the “European paradox“.

As a second example, consider the global value chain for semiconductors, a technology relevant to almost all technology-intensive goods, which has been central to the European Chips Act. As is often lamented, the EU faces difficulties gaining a foothold in the chips market, accounting for only 10 percent of global semiconductor production. What is typically overlooked, however, is that the Dutch company ASML and the German company Siemens EDA are dominant providers of critical inputs for the design and fabrication of chips. ASML, for example, holds a quasi-monopoly in producing lithography systems, machines that print patterns onto silicon wafers for the production of the most advanced microchips used for AI. Despite having these technology leaders in the semiconductor value chain, insufficient domestic production capacities and associated dependence on foreign suppliers such as Taiwan and the US have become problematic in an increasingly hostile geopolitical environment. This is exacerbated by the fact that import substitution by building domestic capacity for chip production takes considerable time and requires substantial upfront investment, with the cost of a new foundry amounting to some $20 billion.

The Galileo project serves as an illustrative example that the EU can catch up in the digital domain, both technologically and commercially. Although a late entrant, Galileo successfully established itself as one of the four currently operating global navigation satellite systems (GNSS). Initiated as part of the EU Space Programme, the Galileo system excels in technological sophistication, being the most precise GNSS. In this context, it should be mentioned that the US strongly opposed the creation of a European navigation system, arguing that the costs of such a huge infrastructure project would far outweigh the benefits, given that Europe could rely on the US Global Positioning System (GPS) for such services.

However, success is not guaranteed, as exemplified by the Gaia-X project, announced in 2020 by the European Commission as part of the European Data Strategy. The aim was to create a federated European cloud infrastructure to ensure that “Europe remains in control of its digital future“. Indeed, the market for cloud infrastructure is dominated by Amazon (AWS), Microsoft (Azure), and Google (Google Cloud), with China’s Alibaba Cloud ranking fourth. Yet, due to a lack of funding, no clearly defined mission goal, and obstruction by US tech giants, this ambitious objective has, at least for now, failed.

Policy Implications

Due to intense geopolitical rivalry, a decline in international cooperation, and the challenges of the EU’s twin transition, industrial policies designed to foster technological sovereignty in key technologies are clearly warranted. Our analysis demonstrates that IT-related technologies are certainly one field where the EU is at a disadvantage and technologically dependent on US and Asian firms. In this context, cloud computing, AI, semiconductors, cybersecurity, 5G technology, and quantum technologies are among the most frequently cited examples. Green technologies for the energy transition represent another critical area where the EU suffers from a lack of technological sovereignty. In particular, the EU lacks technological and production capabilities in batteries and photovoltaic cells.

Beyond such broad technological classifications, identifying the exact areas where technological dependencies pose serious economic and political risks is challenging. Firstly, while data are available at aggregate product or technology levels, actual dependencies may be domain-specific and vary across time, as well as along different segments of global value chains. Secondly, companies are typically better informed about markets and technologies than bureaucrats, and they have every incentive to overstate the importance of their role as suppliers of key technologies to receive subsidies or preferential regulatory treatment. Thirdly, not every dependency should be considered equally problematic. Considering a portfolio of technologies, dependencies can be two-sided, and different countries represent different risks. Finally, the relationship between technological and productive and raw material dependencies needs to be taken into account. For technical and political reasons, mastery of technology without productive capabilities in the EU might be viable for some areas, but not for others.

Consequently, “one-size-fits-all” policies are not advisable. Instead, the EU needs to build-up in-house competencies for permanent monitoring and for forecasting technological dependencies in key technologies as a solid basis for policy formulation. To this end, we suggest the creation of a new organisational unit: the Department for Technological Sovereignty (DTS). The identification of technological dependencies is, of course, very challenging, as it must consider technological, economic and political aspects.

What is more, insights provided by the DTS support political decisions about regulations, subsidies, and other incentives, which potentially have significant impact on the profitability of specific sectors and companies. As a result, any institutional design has to make sure that rent-seeking activities of particular sectoral or technology interest groups are minimised, while the principle of embedded autonomy should be upheld. The latter implies that the identification of technological and industrial bottlenecks is jointly performed on the basis of a broad set of corporate and non-corporate stakeholders of the innovation system.

Institutionally, the DTS could be set up as a new unit within the Joint Research Center (JRC), a department of the European Commission. According to its mission statement, the JRC “provides independent, evidence-based knowledge and science, supporting EU policies to positively impact society.” The JRC has well-established expertise in related fields (scientific portfolios) such as AI and data, strategic technologies or green and just transition. Ideally, the DTS is supplemented by an external advisory body which brings together experts from member states. The aim of this body is to update and complement the work of the DTS with insights and intelligence from a national perspective.

After the DTS has identified critical dependencies, EU industrial policies for technological sovereignty can be designed and should be predicated on the following general principles: clear objectives, realistic technological ambition, effective governance structure, more funding at the EU level, as well as openness and competition.

The improved strategic intelligence capabilities of the EU via the proposed setup of the DTS and the efforts to strengthen the scientific and innovative base, ought to be supplemented with progressive, forward-looking, and targeted industrial policies. Vertical industrial policy initiatives such as the European Chips Act, the Clean Industrial Deal, or the Important Projects of Common European Interest and the more strategic use of trade and investment policy are steps in the right direction. While the path to technological sovereignty will be neither short nor cheap, it is absolutely necessary to reduce the EU’s technological dependencies in selected technological domains.