Against the background of soaring inflation, Europe is witnessing a major distributional conflict between labour and capital. Workers have suffered unprecedented losses of purchasing power. At the same time, companies have generated extra profits in the slipstream of the crisis which in turn are significantly contributing to the persistence of inflation.

Profit inflation, sometimes referred to as ‘greedflation’, has become so obvious that the European Central Bank and the European Commission have recently paid a lot of attention to it. Isabella Weber, Ronald Janssen and others have addressed it on Social Europe. In the new European Collective Bargaining Report of the Economic and Social Science Institute (WSI) of the Hans Böckler Foundation, we take a deeper look at the underlying evidence.

Unprecedented loss

From the perspective of European workers and their families, the inflation crisis is a disaster. Overall nominal wages still increased by 4.8 per cent on average in 2022 and seemed to continue their recovery after the pandemic. But with consumer prices peaking at 11.5 per cent in the EU-27 in October 2022, nothing was left of any recovery gains. On the contrary. Due to the inflation shock, workers lost an astonishing amount of purchasing power last year: real wages plunged by 4.0 per cent on average in the EU—an unprecedented loss.

Particularly hard hit were workers in Estonia (9.3 per cent), Greece (8.2 per cent) and the Czech Republic (8.1 per cent). But even in Germany (4.1 per cent) losses were beyond average. Inflation is exacerbating the social divide in the EU, between regions and within EU countries. It could increase absolute poverty by up to 5 per cent.

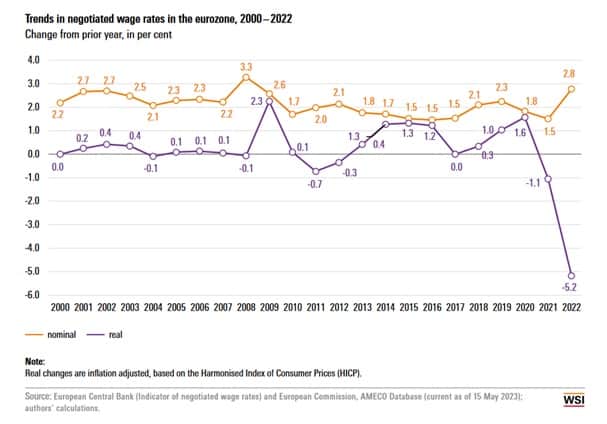

When prices rise as suddenly and radically as they did last year, workers are in a particularly bad position: consumers have no choice but to pay the prices asked for food and other essential products, while trade unions cannot just renegotiate the price of labour from one day to the next. When negotiated wage growth—counting only wages based directly on a collective agreement—reached 2.8 per cent in the last two quarters of 2022, it did not accelerate inflation at all (see figure).

The worst phase of the inflation crisis now seems to be over. Wages are picking up and the commission is expecting overall nominal wage growth of 5.9 per cent in 2023 and (slightly) positive real wage developments in 17 member states. On average, however, workers’ real wages are forecast to fall again by 0.7 per cent on average in the EU-27 this year.

Different position

Companies, too, have complained a lot about rising prices for imported energy and primary products. But they are in very different position compared with workers: when their spending increases, they can raise their prices—especially when everybody else in the same market segment does likewise.

Nor have companies simply adjusted to a changing price environment. Europe’s economic situation has drastically changed in the last three quarters: energy prices have fallen rapidly, while supply-chain problems are being resolved. So why is inflation persistent?

In the wake of the crisis, companies have increased their prices much more than was necessary due to increased costs. While prices were initially driven upwards by higher import prices for fossil fuels, now increased corporate profits are making a significant contribution to the pressure. Throughout the EU, the rates of increase in unit costs of capital—4.6 per cent in 2021, 7.0 per cent 2022 and a forecast of 7.6 per cent for 2023—are significantly higher than those for unit labour costs. This explains why even the commission in its spring economic forecast finds that domestic price pressure is coming from profits in particular.

A look at the contribution of profits to the gross-domestic-product deflator underlines this finding. This indicates how much nominal GDP should be discounted to take account of changes in prices for all the goods and services produced in an economy, to arrive at a ‘real’ figure. In the years from 2010 to 2020, the calculated contribution of companies’ gross operating surpluses to the GDP deflator was 0.5 percentage points on average. In 2021, it rose to 1.5 per cent, then to 2.3 per cent in 2022 and it is forecast to rase to 2.5 per cent this year. Not surprisingly, 2022 was a record year for dividends in the EU, with some €231 billion paid out.

Socially explosive

If many companies are inflation winners while workers have faced unprecedented real-wage losses, this could become a significant problem for distributional justice, with socially explosive potential. Workers and their families are not only carrying the economic burden of the crisis. They have also suffered from a redistribution of their income to capital owners.

The adjusted wage share in national income in the EU-27 has fallen continuously since the pandemic onset year of 2020 (56.8 per cent) and is expected to hit 54.6 per cent in 2023. The sharpness of the decline might be partially explained by the raised baseline value for 2020. But also in a long-term comparison, the wage share is currently unusually low: from 2010 to 2019, it was still at an average of 55.4 per cent in the EU-27.

From a trade-union perspective, what is the scope for wage growth to recuperate from real wage losses and to counter the trend of wealth redistribution from labour to capital? Calculation of the ‘distributionally-neutral margin for wage growth’ gives a hint. Considering productivity growth and price developments, this shows the rate at which wages could grow without diminishing profit margins. In the WSI Collective Bargaining Report we chose the GDP deflator rather than the consumer-price index as it establishes a direct link between the scope for wage growth and the overall functional income distribution between labour and capital.

The calculations suggest that the margin for distributionally-neutral nominal wage growth in 2023 is around 6.7 per cent on average—implying that high wage settlements in many countries and sectors may well be the order of the day. From a macroeconomic perspective, companies which benefited from extraordinary profit increases can employ these as a buffer to absorb recovering wages without necessarily compromising a gradual return to the ECB’s inflation target. The International Monetary Fund suggested as much. Workers should no longer have to carry the burden of the crisis alone. And it is the trade unions whose job it is to defend their interests in a more than difficult economic environment.

Prerequisites for strong wage agreements are, of course, strong collective-bargaining parties with sufficient organisational power and resources. This is certainly not the case in many EU countries and sectors. Therefore, ambitious implementation of the EU minimum-wages directive’s provisions for stronger collective-bargaining coverage could be an important driving force for social justice and future economic stability.

Thilo Janssen is a researcher at the Economic and Social Research Institute (WSI) of the Hans Böckler Stiftung and a correspondent for the European Foundation for the Improvement of Living and Working Conditions (Eurofound), focused on European industrial relations and integration.